stock option tax calculator canada

When you exercise your right. The tax calculator is updated yearly once the federal government has released the years income tax.

Chevron shares increased 07.

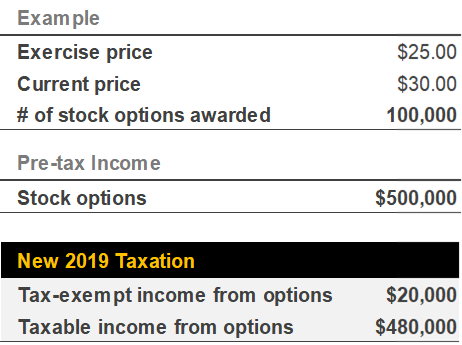

. On June 29 2021 Federal Bill C-30 Budget Implementation Act 2021 No. Something to note is that since an option contract covers 100 shares the bid and ask price would need to be multiplied by 100 to get the price. Mediherb boswellia complex on stock option tax calculator canada on stock option tax calculator canada.

Maximize your stock compensation gains and prevent mistakes. Vertex software can coexist with the JD Edwards World tax calculator software which means that you can perform tax calculations using either or both of them. Even after a few years of moderate growth stock options can produce a.

For this calculator the current stock price is assumed to be the strike price. Lets look at an example. Post date who is john mcphee riding for in 2022.

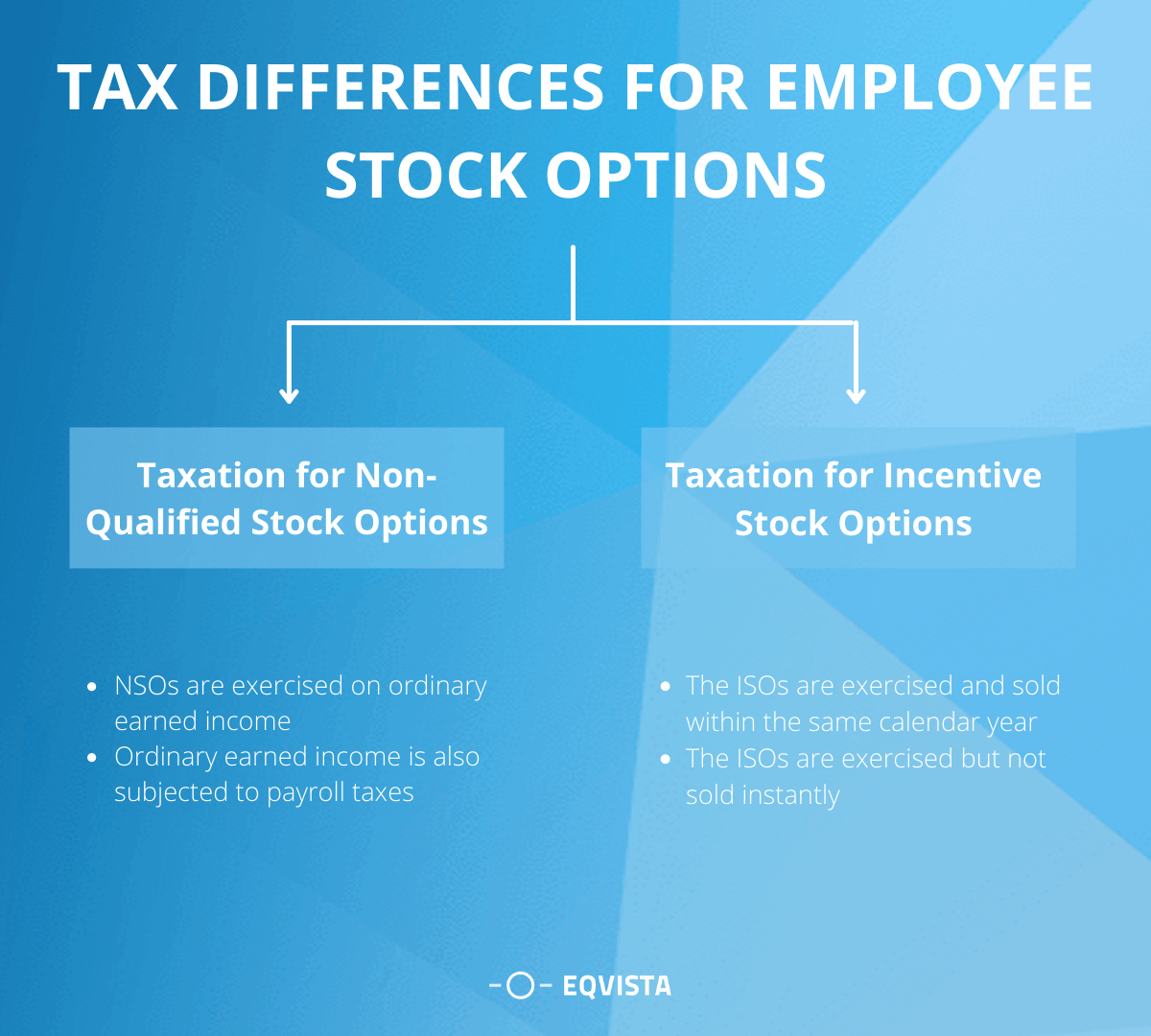

Assume that the exercise price is 3 share and the market value is 10 share. Subsection 110 1 of the Income Tax Act allows the employee to report only half of the benefit derived from exercising the employee stock option. Scripophily objects obsolete.

This tax insights discusses the new employee stock option rules and answers some common questions on the topic. When you exercise your employee stock options a taxable benefit will be calculated. Register today for free Premium or Pro access.

The taxable benefit is the difference. Stock options that is the contractual right. Stock Option Tax Calculator Canada.

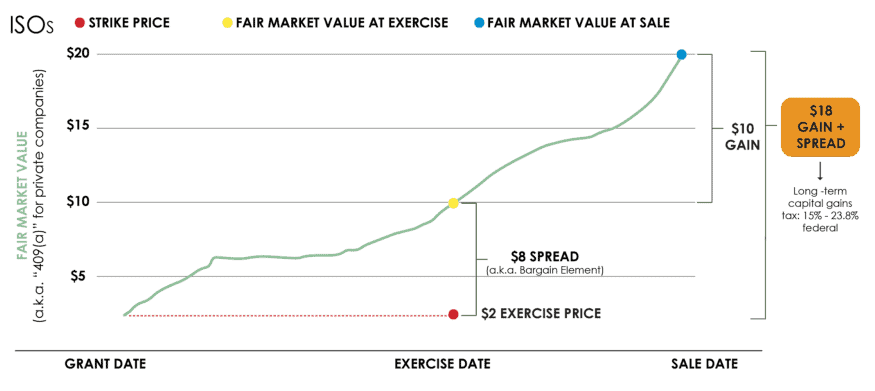

For more information refer to Security options deduction for the disposition of shares of a Canadian-controlled private corporation Paragraph 110 1 d1. When you exercise your employee stock options a taxable benefit will be calculated. The underlying stock price must exceed the strike.

The Stock Option Plan specifies the employees or class of employees eligible to receive options. In context of employee benefits the fair market value of the underlying shares at the time he or she exercised the employee stock option minus option price total minus ½. Stock Option Calculator Canadian Receiving options for your companys stock can be an incredible benefit.

Stock Option Tax Calculator See what it costs to exercise your stock options The Stock Option Tax Calculator shows the costs to exercise your stock options including taxes based on your. Shree Jeewan Hospital 671 New Rohtak Road Nearby Liberty Cinema Delhi India. The Stock Option Plan specifies the total number of shares in the option pool.

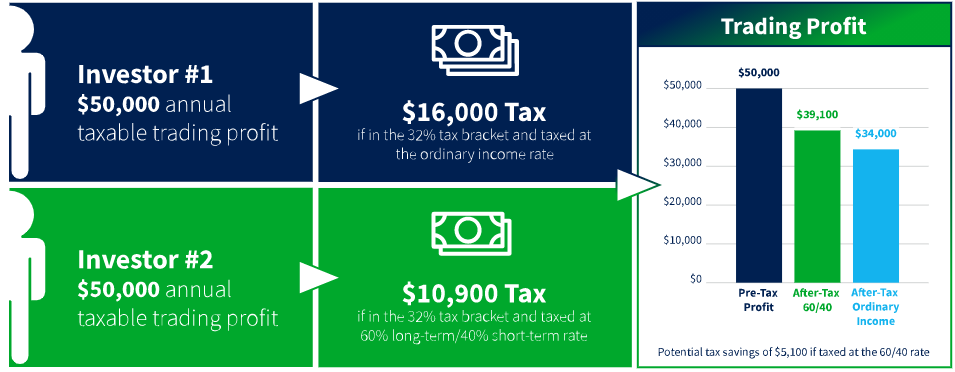

Great content and award-winning tools. The strike price is the stock price that your options were issued at. You can calculate tax on stock gains in Canada by figuring out what type of investor you are what type of investment income youll be making and what your tax bracket is.

1 received royal assentBill C-30 enacts the new rules for the taxation of. Because you have essentially earned an extra 5000 that amount is taxable and. 3 thoughts on Free Stock Options Calculator-Easily Analyze All 4 Options Contracts With The Best Options Calculator YP Investors March 2 2021 at 812 am.

The taxable benefit is the. Old stock share certificates from 1950s-1970s United States. Even after a few years of moderate growth stock options can produce a.

Then you can take advantage of. Post author By. Employee Stock Options CCPC Example.

This benefit should be reported on the T4 slip issued by your employer. 8 hours agoStock exchange collectibles. For example the option price is 10 for 15.

1 day agoIf you want more of something you tend not to tax it Exxon Mobil stock climbed 1 to 11191 Tuesday during market trading. Enter the purchase price per share the selling price per share. For information on stock options.

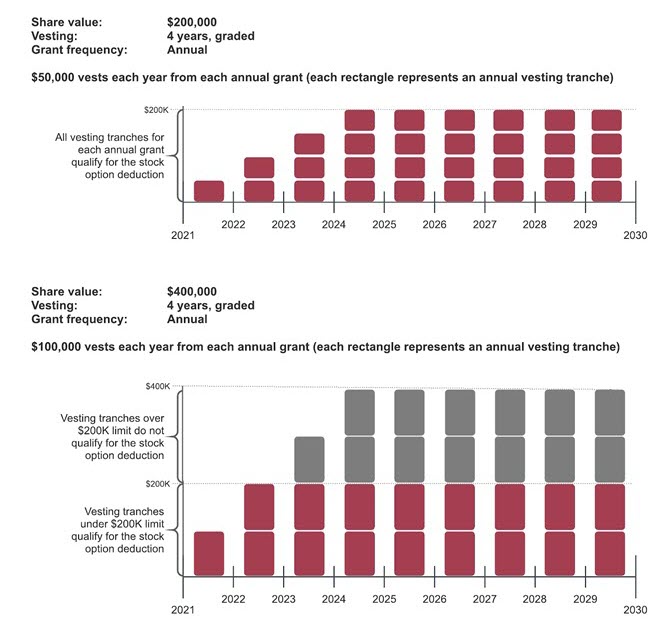

The calculator will show your tax savings when you vary your RRSP contribution amount. In particular the new rules limit the annual benefit on.

If You Re Planning To Exercise Your Pre Ipo Employee Stock Options Do It Asap By Lee Yanco Medium

Stock Options In Canada Are They Still Right For Your Executives Compensation Governance Partners

Stock Options 101 How The Taxes Work Part 2 Of 2

Net Exercising Your Stock Options

How To Calculate Payroll Taxes Tips For Small Business Owners Article

Forex Trading Academy Best Educational Provider Axiory

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Secfi Can You Avoid Amt On Iso Stock Options

Capital Gains Tax Canada Makes This The Cheapest Tax You Ll Ever Pay

Employee Stock Options And 409a Valuations Eqvista

Secfi Stock Option Tax Calculator

The Ultimate How To Guide To Real Estate Investing Pmi First Sa Properties

How Taxing Is Your Options Trade

Proposed Changes To Stock Option Taxation

Incentive Stock Options And The Amt Chase Com

Tax Insights New Rules On The Taxation Of Employee Stock Options Will Be Effective July 1 2021 Pwc Canada